Refinancing House Loan in Singapore with MoneySmart

Today, I will be sharing something very useful for people who are going to get a new flat or calling the banks one by one just to check up on their housing loan packages. I promise this is going to be useful for you as it has been a great help to me.

—————————————————————————–

As all of you know, I have recently gotten my flat before my wedding and this means that I can reprice my property right now.

I was so desperate that I even went online to ask for recommendations.

Truth to be told, James and I went ahead with the bank recommendation for our housing loan from our property agent as she is a friend of ours. She actually gave us the commission and did not keep a single cent. Honestly, we were also quite lazy to call all the banks in Singapore and compare their interest rates one by one.

We had quite good rates when we signed the package but even before any sum was disbursed to the developer, the interest rate increased! We felt extremely pissed off but well, we did not sign up for a fixed interest rate to being with so we only have ourselves to blame for wanting the easy way out.

Don’t be alarm when I tell you that our current interest rate is more than 2%! The only way to console myself is that I am not paying 2.6% for the HDB Loan right now. I went around asking and our interest rate was the highest among my friends.

Having said that, I wished I knew MoneySmart earlier.

MoneySmart.sg is one of the largest financial portals in Southeast Asia region and it allows me to compare financial products like credit cards and housing loans from different banks in a single platform.

If I knew this portal earlier, I might have been able to save some money for the wedding by using the right cards.

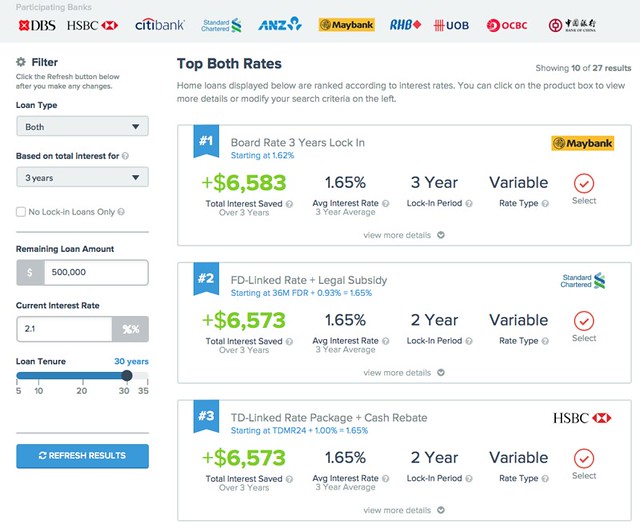

Did you see the picture above? Take a look at the bottom left corner of the screenshot. The current lowest floating is 1.48% and fixed is 1.99%. I thought the fixed rate is still on the high side…

Nonetheless, let’s go in deeper.

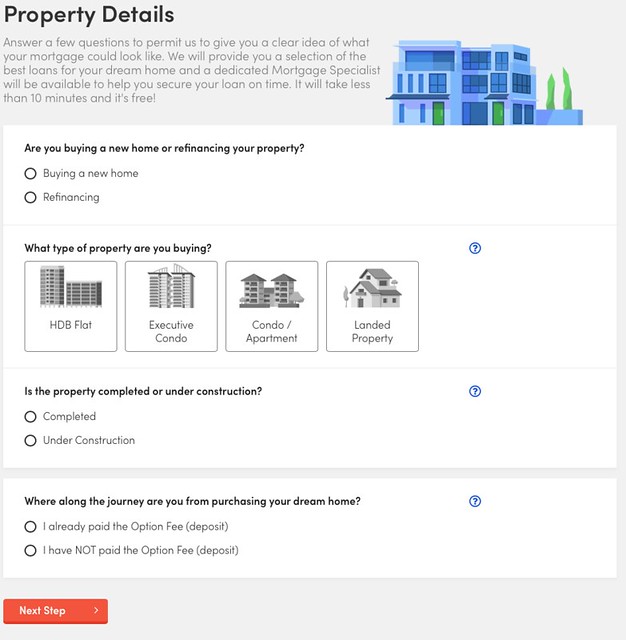

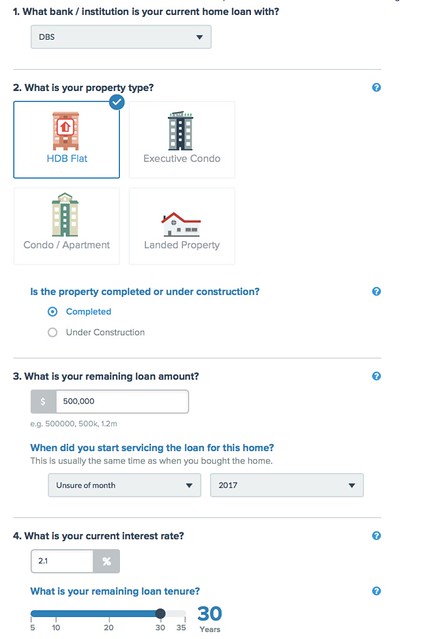

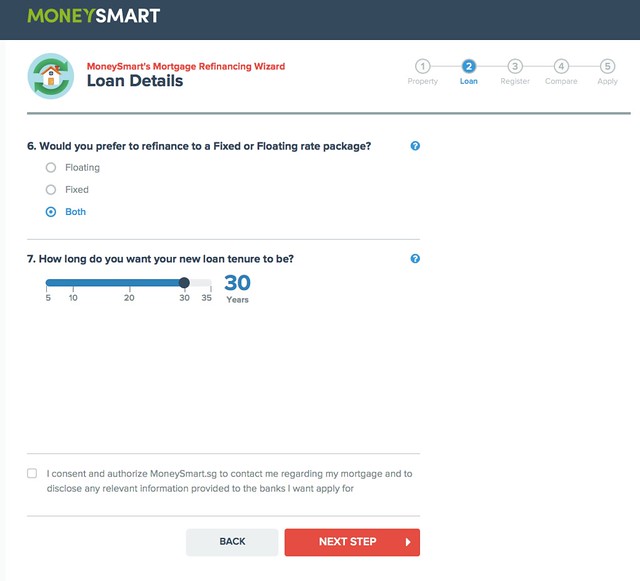

You will be need to answer some questions so that MoneySmart can understand you better.

After answering the questionnaire which will probably take you less than a minute, you will be required to create an account. I chose the easiest option of signing in with Facebook and….

They did my work for me!

There were 27 results for me to compare. Prior to sharing about MoneySmart here, I actually did check out the rates from 3 different banks 1 by 1 as I have to reprice or refinance my housing loan by August 2018.

The interest rates for the 3 banks that I called were exactly the same so I can safely say that the information on the site is up to date. I have also just made my decision on which bank and which package to go for.

If you are as lost as me or if you need more help on these refinancing loans packages, you can visit www.moneysmart.sg/home-loan. Alternatively, if you prefer a more human touch, you can opt to speak to their mortgage specialist after completing the comparison process. 🙂